As the name suggests, Toyota 4Runner is a fore-running sports utility vehicle that has successfully created its own fanbase. Rarely does a car get more popular with age, but that’s exactly what’s happening with the Toyota 4Runner. In recent years, its craze and demand have reached a new peak. But with such popularity, also arises a need for auto insurance. That is why in this article, we will bring you all the important facts about Toyota 4Runner you need to know in 2022. Rates for Insuring your Toyota 4Runner depends on many factors. While the annual insurance costs fluctuate every year, different insurance companies also keep changing their insurance offers. In order to be well updated, you need to know what is the current status of the Toyota 4Runner in your state at that particular year.

What Factors Impact Your Toyota 4Runner Car Insurance Cost?

Various factors determine and affect your insurance rates and quotes of Toyota 4Runner. While some are fixed factors, others are flexible depending on each person. Also, read What Factors Impact Insurance Costs for a Ford?

Fixed Factors

Flexible Factors

Cost to Insure a Toyota 4Runner in 2022

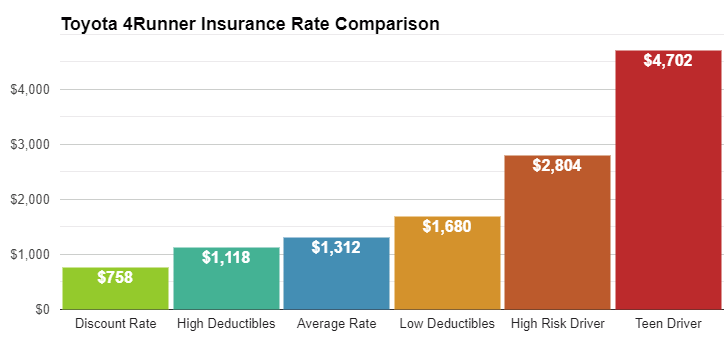

Toyota 4Runner Auto Insurance costs keep changing every year. In recent years, it has shown a slight gradual increase every year. On average, Toyota 4Runner insurance costs $1,552 per year and $129 each month. As per a survey, average midsize SUV insurance costs $1544 a year and according to this, the Toyota 4Runner costs around class average rate, ranking #16 out of 29 vehicles in the midsize SUV class for insurance affordability. Also, Your Toyota 4Runner Model year impacts what will be your Insurance Cost at a particular year. Let’s take a look at how the Toyota 4Runner Insurance Coverage rates differ depending on Your Model Year. Also, read Parked Car Insurance | Save Money on Your Rarely Driven Car Toyota 4Runner Models Full Coverage Insurance Rates in 2022

Which Toyota 4Runner Model is Cheapest to Insure?

With Toyota 4Runner Insurance rates ranging from $1,475 to $1,655 per year, there are few models that come under the budget-friendly category. Out of all these models, SR5 2WD is the cheapest Toyota 4Runner to insure. Following this, SR5 4WD ranks second position among the cheapest Toyota Model to insure. While on the other hand, the top 2 most expensive Toyota 4Runner Models to insure are- TRD Pro 4WD and the Limited 4WD at $1,624 per year. Different Toyota 4Runner Model types are offered different rates of insurance. Take a look ahead to know Toyota 4Runner Most-expensive and Least expensive models to insure- Least Expensive Toyota 4Runner Models to Insure Most Expensive Toyota 4Runner Models to Insure

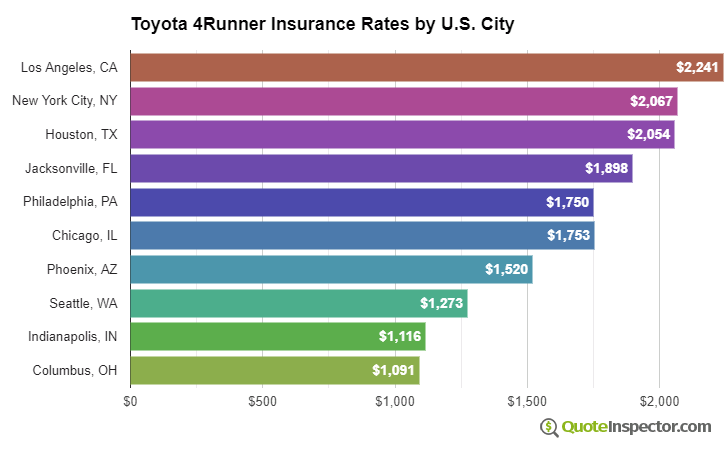

What Does Toyota 4Runner Insurance Cost in My State?

Different US states have their own customized Toyota 4Runner insurance rates. While states like Iowa, North Carolina, and Virginia offer more affordable insurance rates, on the contrary, Rhode Island, Michigan, and Louisana have higher set 4Runner Insurance Rates. To know What is the Toyota 4Runner Insurance Rate in each US State, take help from the Table ahead-

Toyota 4Runner Cheapest Insurance Companies in 2022

According to the most recent survey, the cheapest Toyota 4Runner Insurance Companies in 2022 are- These are the best auto Insurance companies that offer the cheapest price to insure your Toyota 4Runner in 2022. It is always best to check different Insurance rates available at different companies to help get your hands on the best offer. Also, certain other factors and requirements impact which insurance offer is best suited to cater to your needs. If you need a budget-friendly option- then go for Allied and Nationwide. If you are looking for better service and more popular options, Geico and State Farm are your required choice.

Toyota Lease Insurance

Getting to know about your Toyota 4Runner Auto Insurance rates offered by different companies is important but another factor of which you must take note of is the pre-assigned Toyota Lease Insurance coverage. Buyers that lease a vehicle from Toyota dealership are expected by state to have a minimum liability coverage and physical damage coverage rounding to $1,000. These types of coverage help to insure the safety of the Toyota 4Runner incase of emergencies like an accident or theft. This could be fulfilled either by opting for comprehensive or collision coverage. The Toyota GAP which stands for Toyota Guaranteed Auto Protection also commences in the cases of extreme crisis. In times when the primary car insurance policy of your Toyota 4Runner ends up paying less than you owe on the vehicle, GAP covers the depreciated value and helps you recover your losses. This Toyota 4Runner Guaranteed Auto Insurance is provided by Toyota Financial services. It is a great and a must-have add on to your insurance policy coverage. Therefore companies that offer these benefits would always be a better fit for your Toyota 4Runner Auto insurance plans.

Δ