The question is, why choose PayPal if it charges a transfer fee and also during currency exchange? The answer is its endeavor to provide extra security and fraud protection. As of now, there are over 400 million active PayPal users across the world. In case your transfer to a particular account turns out to be a fraud, PayPal will ensure that your money is back in your wallet. To add to its features, PayPal follows the process of encrypting the user’s credit card or bank information. This information is kept safe. Besides personal day-to-day transactions, businesses and retailers are also following the trend of including PayPal for transaction purposes. It gives confidence to the customers to pay internationally without any fraudulent fears from all over the world. So, let us see how much PayPal Charges in USA and other Countries.

How much PayPal Charge in USA and other Countries

No matter what country you are residing in, there is a fee or a transfer amount that PayPal incurs. Let us first figure out the situations when it charges a transaction fee.

- If the payment is received in exchange for goods and services.

- If either the receiver or the sender belongs to a different country altogether.

- If the sender is making payment using a linked credit or debit card except the amount saved in the PayPal wallet.

- Remember, if you are using credit cards or debit cards to make PayPal payments to your friends and family, it won’t charge you a cent.

- In case you are using PayPal for charity or donations for a humble cause, the deduction rate would mellow down.

How much PayPal Charge in USA?

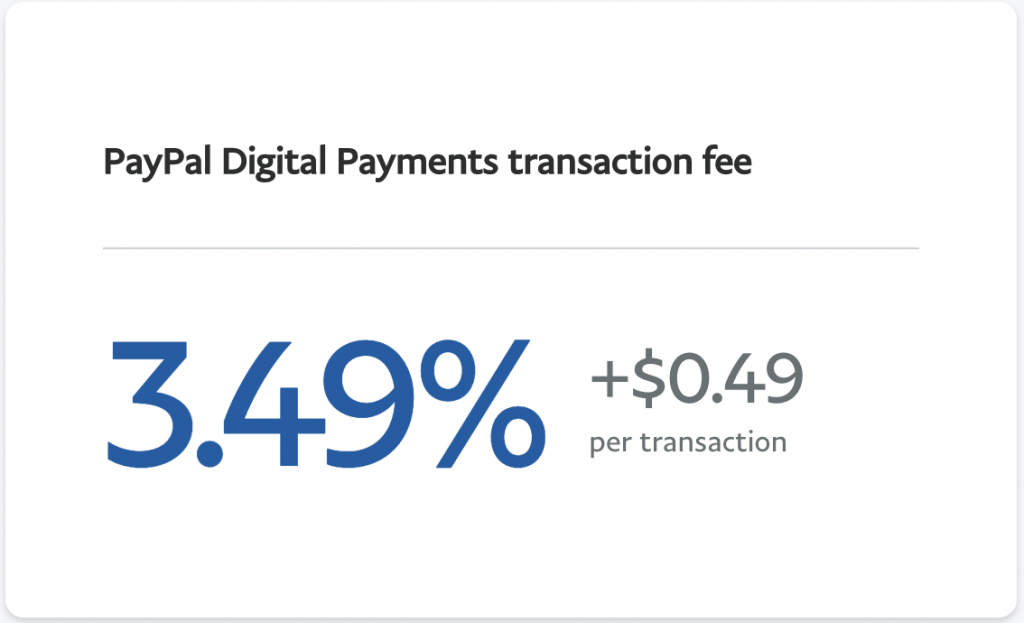

- In the United States, companies or businesses pay a commercial amount or fee of 3.49% of the transaction amount.

- These tools help you calculate and streamline your finances well.

- If you have to refund an amount to a customer on a product/service non-satisfaction or defect basis, a fixed amount based on the region shall remain with PayPal.

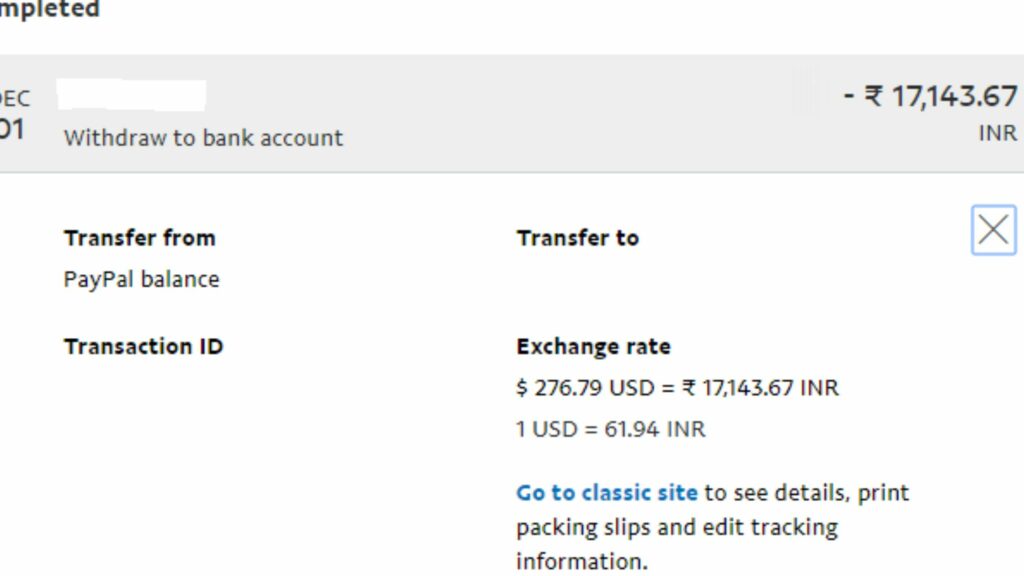

How Much Does PayPal Charge in India?

- In India, PayPal charges a 2.5% fee of the transaction amount besides INR3 which is a fixed fee.

- A high currency exchange rate is also charged; however, if the currency conversion is not involved, it is free to make domestic transactions.

- A commercial transaction means the sale/purchase of goods or services, receiving charity, or receiving a payment.

- Exchange rates vary from country to country. Remember, the fee completely depends on the type of currency conversion.

- A fee of INR 250 is charged in case of a failed money transfer due to incorrect information provided.

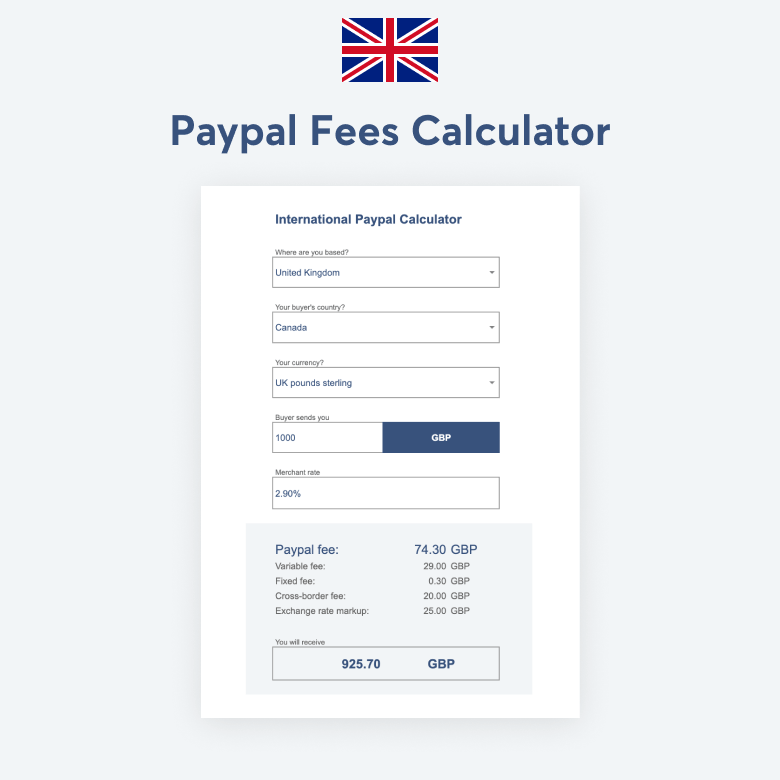

How much PayPal Charges in UK?

- Unless it involves currency conversion, a person can open a PayPal account in the United Kingdom.

- If the transactions are made in GBP to friends and family, PayPal won’t charge any added amount.

- Under International transactions, if both the PayPal parties are residents of the UK, Isle of Man, Guernsey, and Jersey, they shall be treated as domestic transactions.

- Using PayPal to donate or purchase without the use of currency conversion is free.

- In the UK, if you buy or sell goods or services, make transactions on an online portal, or request money using PayPal, it shall be termed a Commercial transaction.

- For selling and buying transactions, 5% of the transaction amount is charged by PayPal. A fee is charged in GBP- A minimum of 0.99 and a Maximum of 2.99.

How Much PayPal Charges in France?

- If a transaction using PayPal is made between both parties residing in the European Economic Area, it is a domestic transaction.

- If a transaction using PayPal is made between both parties from different countries, it is International Transaction. Market Transactions.

- There are different norms for different Market regions.

- National Tariff norms impact international transactions in Europe. The transactions are in Euros or Swedish krona; both sender and the receiver are from the European Economic Area. so, their charges shall be made on the basis of their PayPal account information.

- The minimum Fee for European Economic Area is 3.99 EUR, and the maximum is

Wrapping Up

Now, as we know PayPal can be used for international transactions and is available in over 200 countries, giving companies the option to make cross-border payments and transfers via the app or website at PayPal.com. However, the process differs slightly depending on whether or not both the sender and recipient have a PayPal account. Above, I have tried to mention every aspect in detail for your ease and clarity in the US, India, UK, and France. Every country has its different set of norms depending on the market forces and the regions. I ope it worked for you.

Δ