With so many insurance coverages, it is difficult to make out which one is the right choice? Which Car insurance Company to trust? Progressive or Geico, which company to prefer? And most importantly, What type of insurance does Progressive offer? Don’t sweat; we are here to make your decision easier and your life secured. So, let’s find out which type of Car Insurance Coverage is your desired choice. When it comes to Car Insurance Coverage, one size fits the idea doesn’t work. We need different Car Insurance Coverage Types to cater to our divergent needs. Understanding different coverage types can help you find out the right coverage policy your car needs. These different Car insurance types provide you with different advantages and benefits that can keep your vehicle as well as your financial stability protected. Besides that, there are numerous factors that can impact the policy and its prices. Your credit score is an important thing in the car insurance quotes that you must consider.

Types of Car Insurance Coverages Available for your Benefits

Insurance Coverage means providing you with protection and benefits that will keep your vehicle and yourself protected. But there is no such thing as “Full Coverage” irrespective of what Car insurance companies claim to provide. That is why it is mandatory to know about different Car insurance Coverage types and check for yourself if that company fulfilling your needs or not? Mainly there are 6 Types of Car Insurance Coverages that are provided by the Insurance Companies. Let’s take a look and prioritize them as per your needs.

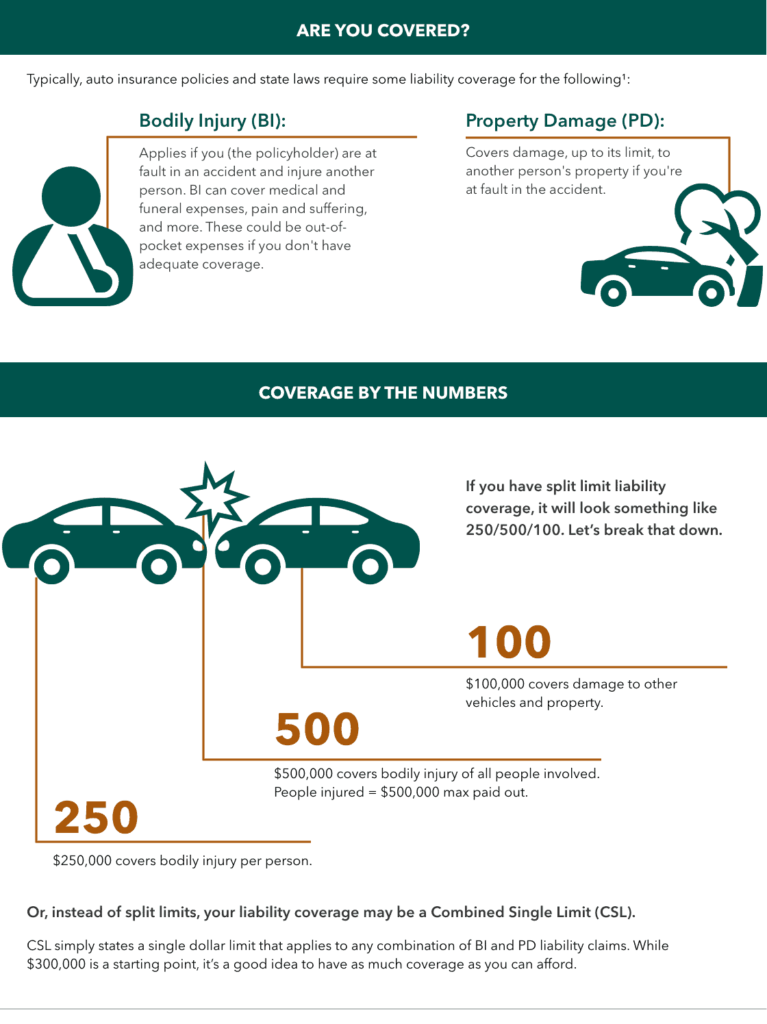

1. Liability Insurance Coverage

One of the most important and mandatory Car Insurance Coverage Types is Liability insurance. Liability Coverage covers the type of accidents that occur as a result of Your actions. It provides protection by covering the cost of any damaged property as well as all the medical bills that come under that particular accident injury. It has been marked necessary in many states, and all the drivers are required to get insured under Car insurance Liability coverage. Liability Insurance has two significant coverages-

Bodily Injury Liability: It pays for damages of bodily injury or death resulting from an accident in which you are at faultProperty Damage Liability: It pays for damages to someone else’s property resulting from an accident in which you are at fault

You must have a Liability Insurance Coverage type to safeguard you in time of emergency. You never know when you might need it. You may also be required to consider an umbrella policy that provides additional coverage for more serious accidents and lawsuits. Also, read Parked Car Insurance | Save Money from your Rarely Driven Car

2. Medical Insurance Coverages

Though I hope there never arises a need to make use of Medical Coverage insurance, it is in your best interest to have a medical insurance policy to protect you from medical payments. If you, your family, or your passengers get into a car accident and are in need of medical attention- then this insurance Coverage type comes in handy. Medical Coverage covers all your costs associated with accident injuries may it be hospital bills, X-rays, some surgery, or scans. Its main benefits are-

Medical Payments coverage: It pays medical bills and expenses related to a car accidentPersonal Injury Protection coverage: It pays for your medical treatment, lost wages, or other accident-related expenses regardless of who’s fault resulted in the accident.

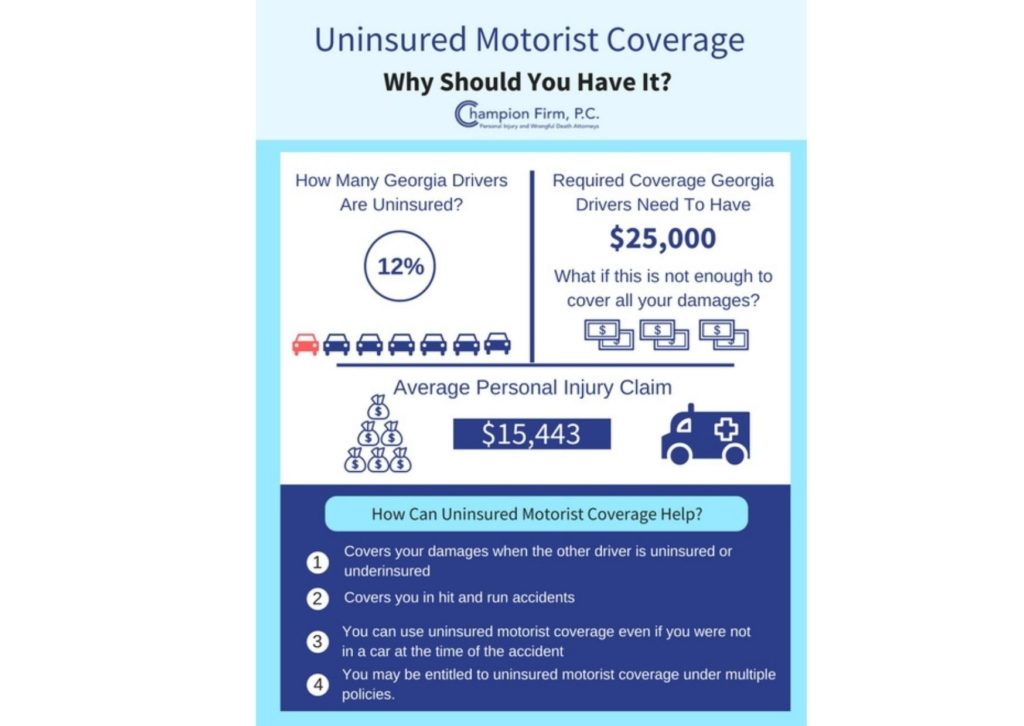

3. Uninsured and Underinsured Motorist Coverages

Though Liability Insurance covers all your accident expenditure when you are at fault, what if it is someone’s else fault? Of course, that person will pay for your bills, but what if that person is uninsured or somehow his Liability Insurance Coverage is unable to pay for such a large amount? At such moments, Uninsured And Underinsured Motorist Coverages come to your rescue. So, if by any chance the legally responsible party is unable to cover all your expenses, then your Uninsured And Underinsured Motorist Coverages will cover your financial crisis. Its main 2 components are-

Uninsured Motorist Coverage: This coverage helps compensate you for your injuries or property damage caused by a driver without insurance. You could claim it when the opposing driver is uninsured.Underinsured Motorist Coverage: This coverage can protect you from at-fault drivers with insufficient insurance coverage to pay your claim. You could claim it when the opposing driver is insured, but his insurance is unable to cover your bills.

Also, read Best Car Insurance for Males Under 25 & How To Save Money in Insurances

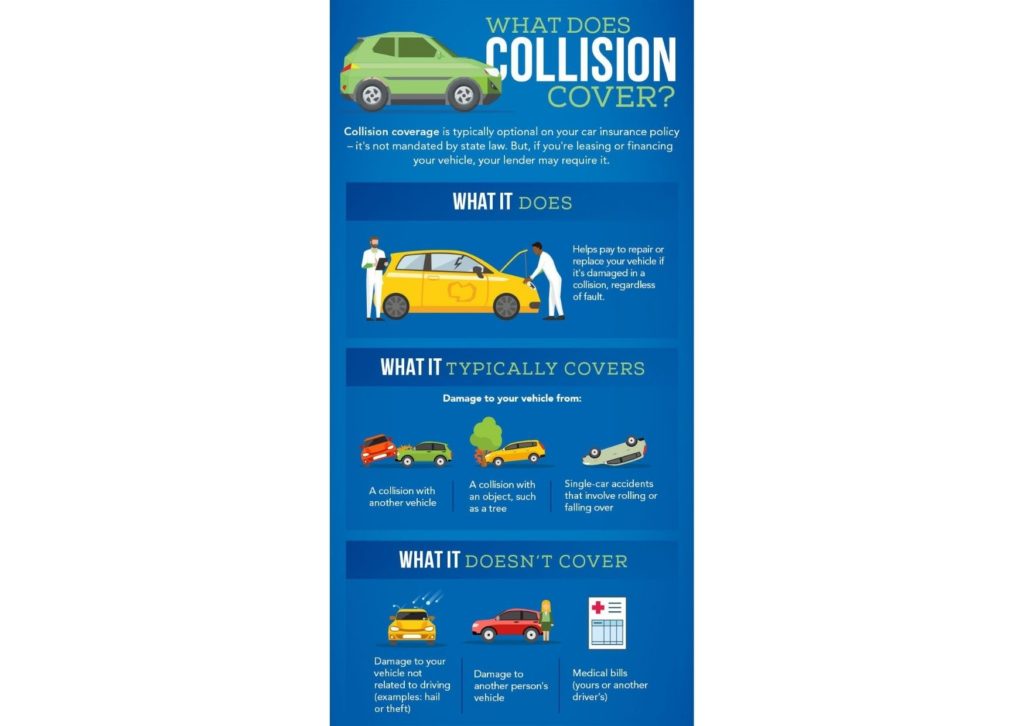

4. Collision Insurance Coverage

Collision Coverage takes responsibility for all the covered accidents mentioned in your Car insurance. This Insurance Coverage Type will pay for all the damages and repairs needed by your vehicle. It usually covers the accident involving a collision with another vehicle or an object. If somehow your car hits or gets hit by a car or an object, Collison Insurance coverage will either repair your car or will pay you the value of the car ( at times of total damage). Its significance is-

Collision Damage coverage: It pays for damage to your car when it hits (or gets hit) another vehicle or other objects like a tree or a fence.Collision Toal Value coverage: It pays for the full value of a car if the repair costs more than the actual value of a car.

5. Comprehensive Insurance Coverage

Keeping all the covered accidents aside, Comprehensive Insurance Coverage takes the responsibility for unrelated accidents. It protects your vehicle by covering the cost during theft, fire, hail, weather damages, or vandalism. During such times, this insurance coverage type will pay for the repair or the vehicle value after negating the deductible. (“A deductible is the amount you’ll pay out of pocket before your insurer reimburses you for a covered claim.”)

Comprehensive Coverage: This coverage pays for damage to your car from theft, vandalism, flood, fire, or other covered losses that are not part of covered collision coverage.

6. Personal Injury Protection Coverage

Personal Injury Protection or PIP is similar to Medical Insurance Coverage, but it also covers additional expenses incurred due to the accident like child care expenses or lost income. Another important element of this is your medical bills along with your passengers will be paid, no matter who is at fault for an accident.

Personal Injury Protection Coverage: It pays for your medical bills and your other expenses like Child Care Expenses.

Also, read Best Car Insurance Calculator in The U.S in 2022 | Calculate Before You Purchase

Other Types of Auto Protection Coverages

Rental reimbursement coverage/transportation expense coverageGap coverageEmergency Road ServiceMechanical Breakdown InsuranceNew car replacement coverageTowing and labor cost coverageSound system coverageClassic car insurance

So these are the main 6 Car Insurance Coverage Types that you need to know about before you make your claim to Car insurance. All of these will help you provide protection and cover your expenses in your time of need. I hope you found this article helpful. Keep visiting Path Of Ex for such insights. And do comment and share your thoughts. Au revoir. Passez une bonne journée..!!

Δ